We're here to help.

Our team of COVID-19 experts can walk you through the forgiveness applications. Our consultations are:

- Confidential

- One-on-one

- No cost

- Virtual

With the new $284 billion Congressional appropriation for small business relief, the federal Paycheck Protection Program (PPP) is now open for new borrowers and certain existing PPP borrowers.

Community financial institutions are currently able to make First Draw PPP Loans and Second Draw PPP Loans on Wednesday, January 13. The PPP program will open to all participating lenders shortly thereafter. Review this list of participating Colorado Community Development Financial Institutions.

In the new rounds of PPP, businesses that use an agent to file their PPP applications will be responsible for covering the corresponding expense for their service. In the 2020 PPP allocations, the lender paid that fee; however, businesses are now responsible for the fee and cannot use PPP funds to reimburse themselves. For PPP applicants that have previously received PPP loans, the financial institution which processed last year’s loan is your best place for you to begin new inquiries.

In preparation, this Prepare for the PPP document outlines the key elements needed to prepare for your PPP application.

Finally, to help guide you through the process, the following links provide detailed information for each corresponding element of the federal stimulus:

- 1st Draw PPP Loans: For qualified recipients that have not previously received a PPP loan

- 2nd Draw PPP Loans: For qualified recipients that have previously received a PPP loan

- Eligible PPP expenses for forgiveness have been expanded

- Guidance on Accessing Capital for Minority, Underserved, Veteran and Women-Owned Businesses

- Changes to Employee Retention Tax Credit

- EIDL and the EIDL Advance program are re-opening for target areas. Information is forthcoming from SBA.

- Shuttered Venue Grants: Businesses who qualify for this grant cannot receive this grant and new PPP funds. They will need to make a decision as to which funding source makes the most sense for their business.

SBA, in consultation with the U.S. Treasury Department, reopened the Paycheck Protection Program loan portal on Monday, January 11, 2021 at 9 am ET. It will initially accept First Draw PPP loan applications from participating CFIs, which include Community Development Financial Institutions (CDFIs), Minority Depository Institutions (MDIs), Certified Development Companies (CDCs), and Microloan Intermediaries and Second Draw PPP Loans on Wednesday, January 13.

To apply, contact your PPP lender and complete the correct form. Review this list of participating Colorado Community Development Financial Institutions.

In the new rounds of PPP, businesses that use an agent to file their PPP applications will be responsible for covering the corresponding expense for their service. In the 2020 PPP allocations, the lender paid that fee; however, businesses are now responsible for the fee and cannot use PPP funds to reimburse themselves. For PPP applicants that have previously received PPP loans, the financial institution which processed last year’s loan is your best place for you to begin new inquiries.

We have had a number of businesses contact us recently who have been concerned that their loan documents for the PPP require them to start making payments in the very near future. This is not the case.

The original CARES ACT contained language that made this true and if you received a PPP loan in the beginning of the process your lender would have included language in your loan documents that made this the case. However, the FLEXIBILITY ACT changed the payment schedule and deferred your first payment for a long time. Interest will accrue on any unforgiven portion of your PPP from the date you received a disbursement, but your first payment will not be due until much later in the process. Please note that if you received an EIDL Advance it will not be forgiven and will be treated as a PPP Loan.

We have found that many lenders have not formally notified businesses of this change and we know of no lenders that have taken the step of modifying the language in the PPP loan documents. Regardless, your first payment is not currently due. Here is language from the SBA that was issued in the form of a FAQ in early October.

Question: The Paycheck Protection Program Flexibility Act of 2020 (Flexibility Act) extended the deferral period for borrower payments of principal, interest, and fees on all PPP loans to the date that SBA remits the borrower’s loan forgiveness amount to the lender (or, if the borrower does not apply for loan forgiveness, 10 months after the end of the borrower’s loan forgiveness covered period). Previously, the deferral period could end after 6 months. Are lenders and borrowers required to modify promissory notes used for PPP loans to reflect the extended deferral period?

Answer: The extension of the deferral period under the Flexibility Act automatically applies to all PPP loans. Lenders are required to give immediate effect to the statutory extension and should notify borrowers of the change to the deferral period. SBA does not require a formal modification to the promissory note. A modification of a promissory note to reflect the required statutory deferral period under the Flexibility Act will have no effect on the SBA’s guarantee of a PPP loan.

Loan Forgiveness Application: "The Long Form"

PPP EZ Loan Forgiveness Application: "The Short Form"

Step-by-Step Video of PPP EZ Loan Forgiveness Application

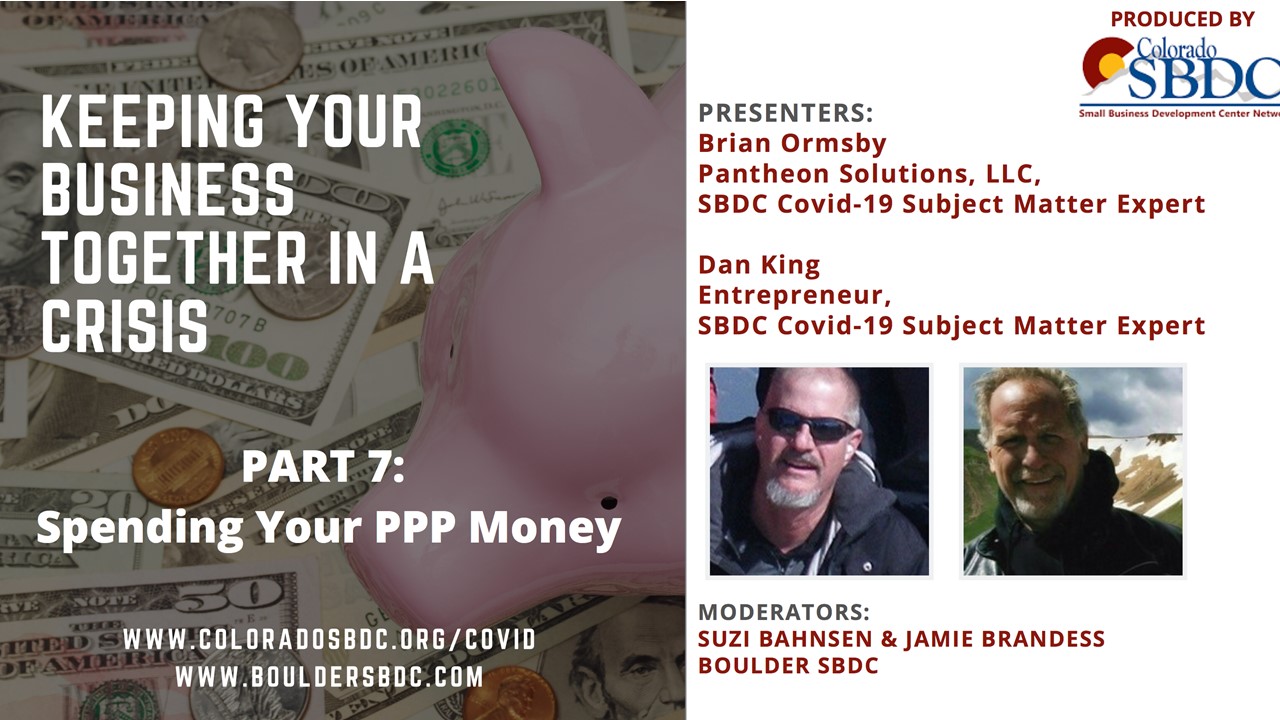

By Dan King, SBDC COVID Expert

Loan Forgiveness Application: 3508S (for amounts under $50,000)

Additional Loan Forgiveness Documents

PPP Lenders

PPP Lenders: Longmont